Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Back in 2017 it was ‘the thing’ to be buying and selling Bitcoin and other cryptocurrencies like Ethereum, Litecoin and XRP (Ripple). It was also ‘the thing’ to get into Bitcoin mining to make Bitcoin (or other cryptocurrencies) for yourself.

However, in 2018, the bottom dropped out of the cryptocurrency market for quite a few months and it all went a bit quiet.

It didn’t go away, though, and, in my opinion, cryptocurrencies are the future. I don’t know how far in the future but I do feel they’re the future.

Bitcoin mining is still going on, even though the rewards go up and down. At its height, a single Bitcoin was equivalent to around $20,000, then it went down to more like $4,000 but now it’s back up to $19,000. Any moment now it could plunge back down again, so don’t think of this as a steady earner!

To understand what Bitcoin mining means, you first have to know what Bitcoin is and how it works. So, here goes!…

Now before you freak-out at the very idea of Bitcoin, or cryptocurrencies generally, take a breath for a moment and remind yourself that you’re already quite used to digital money at least.

You might have some cash in your wallet right now but you probably have credit and debit cards too. In fact, it’s highly likely that you now use your cards more than your cash. if you’re under 45 or a townie you’re likely to have no cash at all in your wallet and you can’t even remember the last time you went to an ATM!

So, having embraced digital money, it’s not too much of a step to go to cryptocurrency. And that is what Bitcoin is: it’s a cryptocurrency – the original one in fact – and it has given birth to hundreds and hundreds of other cryptocurrencies (known generally as alt-coins) that most people have never heard of (and, in most cases, probably never will).

The next most popular cryptocurrency is Ethereum, followed by a few other favourites such as Litecoin, Zcash, Dash, Ripple, Monero, Bitcoin Cash and NEO.

In fact, when we talk about Bitcoin mining, we really mean mining for a few different currencies. If you get into this activity you could find yourself mining mostly Ethereum or Litecoin perhaps, rather than actual Bitcoin.

You’ve probably worked this out already, but cryptocurrencies aren’t an actual ‘thing’.

You can’t see or feel them like you can with folding money or credit cards.

They’re barely blips on a screen.

They’re pretty much just numbers but they are numbers that can buy you things. Some companies – particularly internet companies – will give you goods and services in exchange for cryptocurrency payments (mainly Bitcoin or Ethereum), but what’s more likely is that you will exchange these ‘coins’ for FIAT currency (i.e. pounds, dollars, euros etc).

So the first thing you need to know about Bitcoin is that it is decentralised.

It sounds like you dig these funny Bitcoins out of the ground, like gold or zinc or diamonds.

But actually, the ‘mining’ element means using powerful computers to unlock very, very complicated cryptographic puzzles which protect the transactions.

The way the Bitcoin network has been set up means that there are only 21 million Bitcoin in existence. Many of those have not seen the light of day yet. What ‘miners’ do is to bring them into general use a few at a time.

They get to do this by sorting out the complicated puzzles that make transactions secure. Each time they sort out one of these puzzles – and therefore ratify transactions – they get ‘rewarded’ with a bit of Bitcoin.

So a Bitcoin miner is someone who can earn Bitcoin by running one or more powerful computers to unlock those clever puzzles, 24/7.

Check out this video to find out more about what a Bitcoin miner does

Bitcoin runs on technology called ‘Blockchain’.

Some people confuse Bitcoin and blockchain but they are quite different entities.

Blockchain is the decentralised technology on which cryptocurrencies like Bitcoin run, but it is also the platform for all sorts of transactions, not just cryptocurrency. In fact blockchain could revolutionise the way we live our lives. It can be used in all sorts of areas of life such as voting, medicine, education, property transactions and much more.

The blockchain stores information across millions of personal computers across the world, recording transactions in real-time. With the blockchain you can’t rub out any transactions, you can only add. So if you want to reverse a transaction you have to do it again in reverse. No one can go in and change a transaction. Everyone can see what is being done so it’s impossible to commit fraud on it (at least that’s the theory).

There’s a nice two-minute explanation of what blockchain is here, if you’d like to know more:

…a bit anyway.

Nodes are essentially hardware that store the blockchain. So your computer – should you choose to be a miner – is a node. It’s supposed to store the entire blockchain (and that’s a lot of GB by the way) and it has to verify the blocks of information as they are added.

It’s all very energy-hungry so be warned!

Actually it could be, depending on how cheaply you can get your electricity and hardware.

I often quote the multi-billionaire investor Warren Buffett who famously said of investors that you should be “Fearful when others are greedy and greedy when others are fearful.”. In other words, be contrarian, be different. Go against the crowd. That’s usually the best way to make money.

Right now, cryptocurrencies – and Bitcoin in particular – are still looked askance by traditional investors (though less so than they used to be). You don’t hear people talking about them all the time in cities like you used to. In 2017 although they have become of interest again in the least few months. So it means that things have calmed down a bit; prices for equipment are not quite so crazy and many of the con-artists who had slid into this sector have either got bored and picked on another industry or have been found out and closed down.

So, although the rewards are up and down (currently up but they could go down again at any moment), they are still not bad and, in my opinion, are likely to increase over the next few years.

If you’re genuinely interested in this idea and have the space to house the equipment, now is as good a time as any to get into Bitcoin mining.

Depending on your strategy and the number of resources you are willing to put in mining, you can implement different strategies. Either collaborating in mining pools in which you will be able to share your resources with a group of other miners or investing a huge capital to mine a popular cryptocurrency such as Bitcoin or other altcoins.

For normal people like you and I, the best thing to do is to get a machine from Coinmine.com which is a ‘plug and play’ product for mining at home. It looks a bit like an Xbox and they say it takes just five minutes to set up.

It’s a nifty product that you can put anywhere – they say their customers stick it in the garage, in their bedroom, in the living room or in their mum’s basement. Wherever there is wifi – and an electricity source – it will work.

You can mine Bitcoin and alt-coins Etherium, Monero, Zcash and Grin with it. If you want to, you can cpnvert alt-coins into Bitcoin as you go.

It costs $699 and ships around the world.

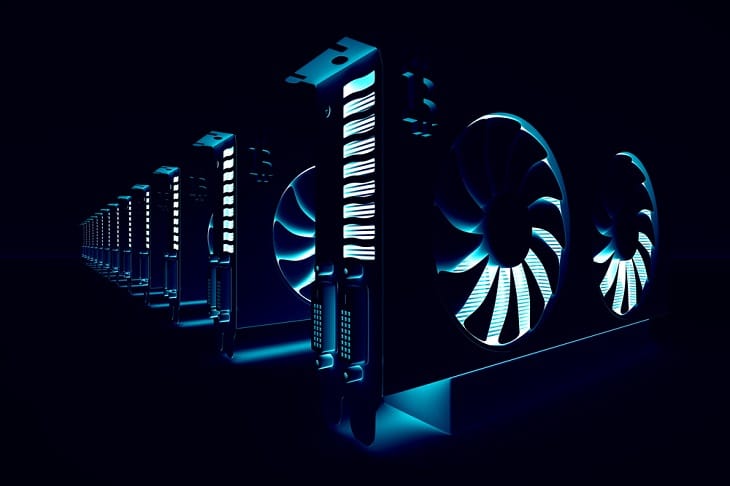

If you want to set up your ‘node’ in a really serious way you need a load of computing power because you’re going to have to store the blockchain and act on it to unlock the transactions so you will need

It’s so tough to mine cryptocurrencies now (i.e. it takes such a lot of power to do it) that you need a machine called an ASIC to help you.

A Bitcoin ASIC is a specialised Bitcoin mining computer, or “bitcoin generator”. All serious Bitcoin mining is performed on dedicated Bitcoin mining hardware ASICs, usually in specially-cooled data-centres with low-cost electricity.

Quite a few companies do ASICs. Some recommended ones are:

You will also need some other bits of equipment if you’re serious about it:

The above is what serious miners have and they tend to store it all in a large shed or commercial space somewhere.

For you and me, the Coinmine solution is probably best.

This is how you get paid.

Get yourself a Bitcoin wallet like ‘Bitcoin Wallet‘ or ‘Bitcoin Core‘

Or you could just set it up on a cryptocurrency exchange like Luo.com, as that makes it easier to transfer the Bitcoin into Sterling, dollars or euros.

You will need software on your computer that will do the mining for you. Once you hook everything up it will work out for you which cryptocurrencies are best to mine in your space, then it will get on with it.

Good mining software to go for include:

Once you have set up the machines to work on the transactions you can pretty much let them get on with it.

It’s important to make sure they are kept cool. There could be a fire hazard if they overheat and, of course, the machines themselves will go down if they get too hot.

Otherwise, though, you can leave them to do their work.

The main costs to you are

Not surprisingly, Bitcoin mining is particularly popular in countries where electricity is cheap and also, ideally, where the weather is cold so that the machines can be kept cool.

The cost of electricity to the power system and the price of your computer system determine if it will be a profitable measure to take. If you are considering Bitcoin mining as your next venture, make sure you carefully consider the expenses as well.

Rather hilariously, a year or so ago in Iran quite a few locals set up Bitcoin-mining operations in their mosques because they get their electricity for free. Clever eh?

You get paid in Bitcoin itself, so as far as Sterling or US dollars are concerned, the actual amount you make will depend on the current value of Bitcoin, which changes every day.

However, if we talk in Bitcoin only, in the UK, where electricity is relatively expensive, right now it’s not going to be a massive earner for you. However, once you’ve set up the machines and have it running, it’s not like it’s going to be much work for you either.

The profit you make will depend on the current value of Bitcoin (or the other cryptocurrencies you are mining) minus the cost of the machines you’ve bought and the hourly electricity cost. And it’s that electricity cost (particularly in the UK) that can be a real downer when it comes to your earning power.

By the way, see here if you can get your electricity much cheaper.

This guy says he makes $35 a day (about £1,000 a month) just through mining for cryptocurrencies, but then he’s managed to keep his costs right down.

He has also worked out that it takes about 2-3 months to pay off the cost of his machinery just by Bitcoin mining.

The big question – and the one most miners rely on – is what will be the value of Bitcoin and other major cryptocurrencies in the future.

It’s possible that the currencies you ‘mine’ right now could shoot up in value over the next few years. You don’t know that – no one does – and it’s quite a gamble. However, if you are managing to at least cover your costs now – and even make a bit of a profit – it could be really worth your while keeping hold of the currencies as a potential future investment.

I repeat: it’s quite a gamble. No one knows what will happen to cryptocurrencies in the future. But as far as I’m concerned, it IS the future. We are just at the foetal stages of this very interesting financial development, like being at the beginning of credit cards.

Ultimately, though, it’s up to you!

Jasmine Birtles is not a bitcoin miner but does invest in cryptocurrencies including bitcoin, ethereum, litecoin and XRP.

Disclaimer: MoneyMagpie is not a licensed financial advisor and therefore information found here including opinions, commentary, suggestions or strategies are for informational, entertainment or educational purposes only. This should not be considered as financial advice. Anyone thinking of investing should conduct their own due diligence.

Intriguing. Something I’d definitely like to look further into.

I am all for cryptocurrencies. I liked the idea of mining ages ago when I first heard about it, but Jasmine is right to add the words of caution, these days – if you cannot set up correctly you can lose rather than make money from this because the costs have escalated so much. Not for the fainthearted!

Interesting article.