Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

If you have just filed your Self-Assessment tax form…well done. What an awful job that you’ve crossed off your list!

But did it remind you, yet again, just how much money you’re giving to the government, to waste in its own special way, and just how annoyed you are at what that money is NOT getting you?

That was what came to my mind when I pressed the button sending an offensively large amount of tax (in my view) from my bank account to the black hole that is known as HM Treasury.

I spoke to a friend of mine in Norway about it at the weekend. They have even higher taxes than we do – particularly income tax – but they feel that they do get something back for it.

Hi asked where we are compared to other countries when it comes to the amount of tax we pay.

Good question, i thought. Frankly I don’t know.

So I looked it up and it turns out that even with the latest ridiculous tax rises (from the so-called party of low taxation, the Conservatives) we actually pay less tax than the average for developed countries – even lower than most Eastern European countries

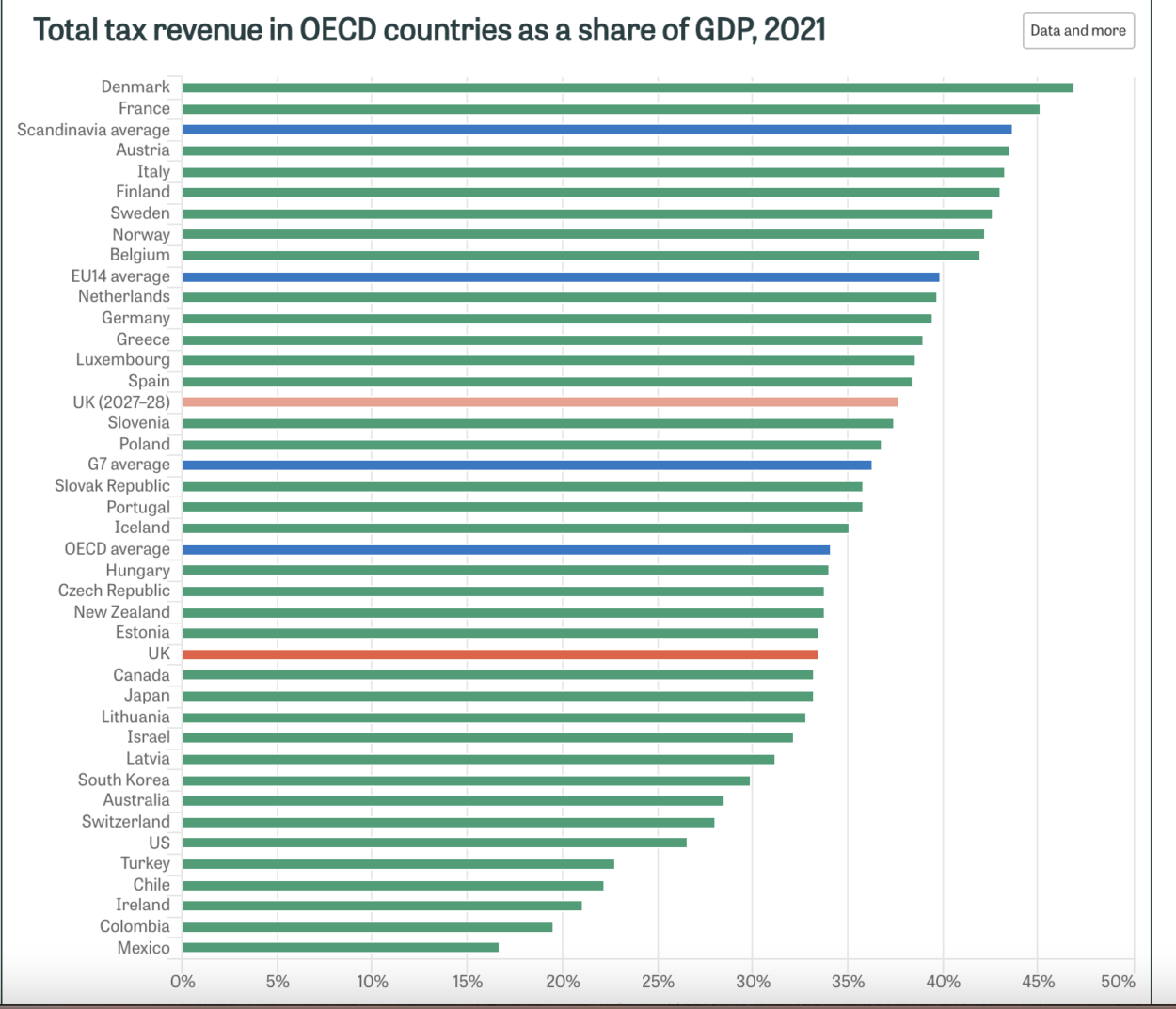

Here’s a graph from IFS Tax Lab that shows where we are:

As you can see here, we are way down the list when it comes to total taxation.

It doesn’t feel like it though does it?

There is growing concern in the country about the amount we are spending in tax – largely thanks to Sunak and Hunt freezing the income tax thresholds – compared to what we are getting for the money.

It really feels as though croneyism (corruption) and plain incompetence across the board mean that most of the money we pay doesn’t go where it should. Our National Health Service is broken, education is under-funded (£60 bn a year compared to £112 bn for the State Pension last year), the country’s roads are full of potholes, our Care system is in tatters…I could go on.

To be fair, though, we don’t have so much of the depressing capital taxes that other countries – particularly those in Europe – stagger under.

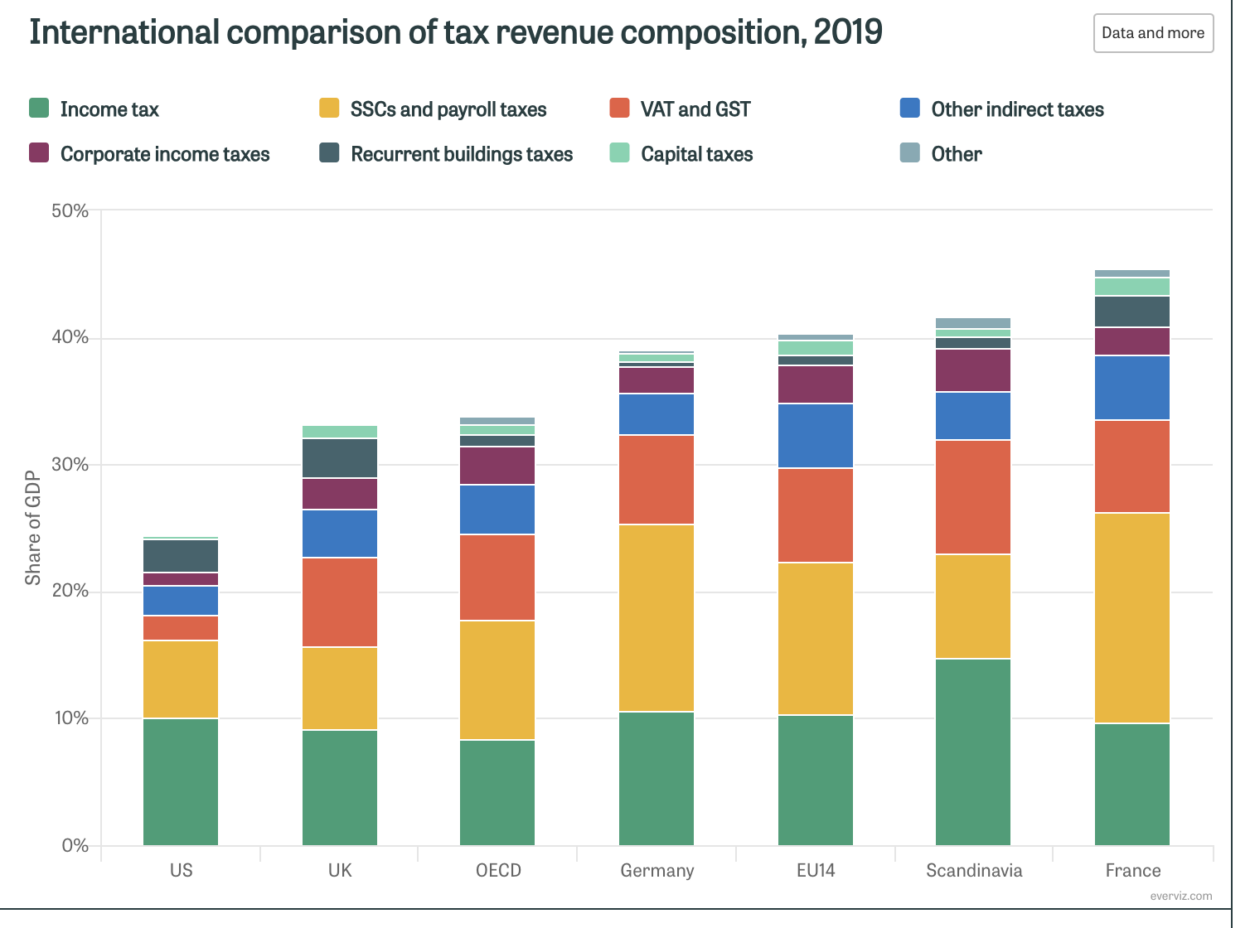

This graph shows what sort of taxes some of our neighbours pay, compared to those that we pay. Clearly the majority for us are related to income…nasty but perhaps not as bad as they might be. Other countries have a raft of ways they can be made to pay that we don’t have…

Our VAT bill is relatively low compared to other countries, which is a help to commerce, but in my opinion it could still be lower. Certainly if you speak to small businesses – particularly those with a physical presence on the high street – the number one tax they want to see reduced is VAT.

I am not against paying tax. I think it’s the mark of a civilised country that everyone who can pay does pay into the general pot to keep services going.

What I object to is badly thought-out taxes that are poorly managed and are so complicated that those with expensive accountants (i.e. the super-rich) can get out of paying the majority of them, while the rest of us shoulder yet more of the burden.

It’s not just a problem here – the mega billionaires around the world pay minimal tax because they have clever teams of accountants that make sure they pay as little as possible.

What we need, for starters, is:

Do you agree?

What do you think should be done about tax in this country?

Tell me in the comments below 🙂

Spot on! The Tories, in particular, are in it just to fill their own pockets. Why is Jacob Rees-Mogg a politician?